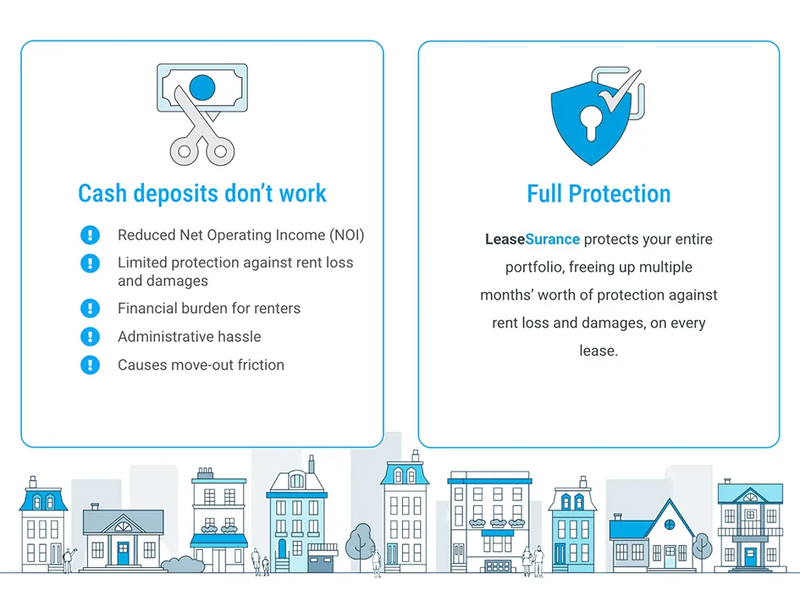

Founded in 2021 with a team of experienced professionals in property management, LeaseSurance addresses the financial and administrative burdens associated with tenant deposits for landlords and tenants alike. Instead of requiring a traditional upfront deposit, LeaseSurance offers an innovative insurance model where tenants pay a small monthly fee, bundled with their rent, that secures landlords with adequate coverage in case of damage.

LeaseSurance

Overview

Challenge

Following a successful validation and pilot phase, LeaseSurance had a proven concept, but scaling it posed new challenges. They needed technology that could handle thousands of properties, assess risk accurately, and process claims automatically - all while keeping costs low enough to maintain their affordable pricing model. Octoco joined as their technology partner to provide not just engineering support, but also strategic and technical leadership through a Fractional CTO partnership.

Objective

The dual goals were:

- Engineering: Build a robust, scalable platform that reduces manual effort and increases accuracy.

- Strategic: Step in as interim technical lead to help shape the product direction, make key architecture choices, and build a solid foundation for long-term growth.

Key focus areas included:

- Implement data-driven risk profiling for pricing and claims accuracy

- Enable low-cost, high-volume administration with deep automation

- Streamline claims processes and reduce manual workload

- Future-proof the platform for scale, compliance, and integrations

Solution

Octoco took the lead on building the platform from the ground up, handling both the technical work and helping guide the bigger picture strategy.

As part of our Fractional CTO service, we worked closely with the team to plan the roadmap, make smart decisions about budget allocation and figure out which features would bring the most value early on.

Our engineering team rebuilt the platform with key improvements:

- Real-Time Data Ingestion via API Integration: Built a real-time data pipeline that integrates directly with third-party property management systems. This enabled the continuous synchronisation of lease, tenant, and payment data.

- Claims Processing Engine with Risk Profiling: Designed a modular claims engine that automates evaluation using embedded policy rules, risk scoring logic, and payout calculations. This system streamlines end-to-end claims management.

- Role-Based Interfaces and Access Controls: Developed tailored user interfaces for landlords, underwriting partners, and internal teams, with role-specific dashboards and granular access control to support secure, efficient workflows.

Implementation

As part of the engagement, Heinrich joined the team as a Fractional CTO, working closely with the founders to shape LeaseSurance’s product and tech strategy. By being hands-on and involved day-to-day, he helped steer technical decisions to make sure they supported the company’s overall goals.

With the roadmap and priorities aligned, Octoco’s engineers rebuilt the platform to support real-world usage at scale. The main improvements included automated data syncs and claims management. The tight feedback loop between strategic planning and technical execution allowed us to move quickly without sacrificing quality or scalability.

Result

The collaboration delivered transformative improvements:

- Improved product speed, accuracy, and overall service quality

- Achieved financial viability through deep automation, enabling cost-effective scaling

- Faster onboarding processes support efficient client acquisition and portfolio growth

- A strong, future-ready foundation now positions LeaseSurance for broader market expansion