What is Venture Building in South Africa?

Inside the Corporate Innovation Playbook

In a rapidly evolving business landscape of AI, tech advances, and business model innovations, businesses in South Africa face increasing pressure to remain agile and forward-thinking.

Innovative disruptors are coming in and capturing large portions of traditional markets. So how do South African companies maintain their current business, but still be part of the new, exciting wave of innovation?

The answer comes from the space that kickstarted and maintains the disruptive new venture model: the startup space. But with a twist – venture building is when corporates crank up their innovation machines and start acting and thinking like game-changing entrepreneurs, yet in a logical, risk-managed, and entirely business-beneficial way.

The ultimate form of future-proofing, if you will.

This is what you should know about venture building in South Africa:

What is Venture Building?

Hailing from the startup world (where tech-savvy entrepreneurs have refined building incredibly strong, future-forward and scalable new businesses at remarkable rates), venture building is a hands-on approach to creating new businesses from the ground up.

It’s taking an idea or market opportunity and then iteratively building and testing ideas and products to try and achieve market fit, all the while intending to rapidly scale the venture as soon as you have traction.

Think Uber: Start with an idea (what if we get people to drive each other around instead of taxis?), test it out, build a platform and then, as soon as you are confident it can actually work, get investment and focus on growing so fast that you’re active in every city and deeply entrenched in popular culture before anyone even realises.

And Corporate Venture Building?

Corporate venture building is similar, except instead of a startup entrepreneur, an established business takes the initiative – imagine if a taxi company built Uber before Uber did. Or a hotel chain started Airbnb. It’s actually way more common than you think.

Checkers 60Sixty is a corporate venture: Shoprite/Checkers gave a super tech-savvy young team a challenge and free reign to test and implement, and one of South Africa’s biggest and most successful ventures was the result.

Think of it this way: If Checkers didn’t do it, someone else would have, and that’s why every South African corporate should be heavily invested in venture building…

Who Needs Venture Building & Why?

Let’s face it, corporates are only big and successful because they have one or two major revenue streams that they are the absolute experts in. But future-proofing requires taking bold new leaps into unknown territory, trying new things and sometimes failing – the antithesis of any corporation’s usual nature.

So who needs venture building? The corporate that’s grateful for its success over the last 30, 40, or 50+ years, but knows that it needs to move fast to secure the next 50. Because some young upstart is going to try to disrupt their industry, it might as well be one that they own.

In South Africa, industries like financial services, telecoms, and retail face mounting pressure to innovate. Venture building enables these companies to experiment without disrupting core operations, fostering a culture of continuous innovation.

Not sure if it’s for you? See what happens to companies that lack innovation.

The Benefits of Corporate Venture Building in South Africa

Corporate venture building offers several advantages:

- Speed to market: Test, iterate and launch new ventures faster through structured processes and experienced teams.

- Reduced risk: Benefit from rigorous validation stages to ensure market fit.

- Strategic alignment: Create ventures aligned with long-term corporate objectives.

- Resource efficiency: Leverage existing assets while avoiding common startup pitfalls.

- Access to talent & expertise: Partner with specialists like Octoco for venture building, engineering, product development, and market strategy.

See why venture building is vital to your diversification strategy, how to use it to unlock more operational efficiency and learn how to identify opportunities to increase efficiency.

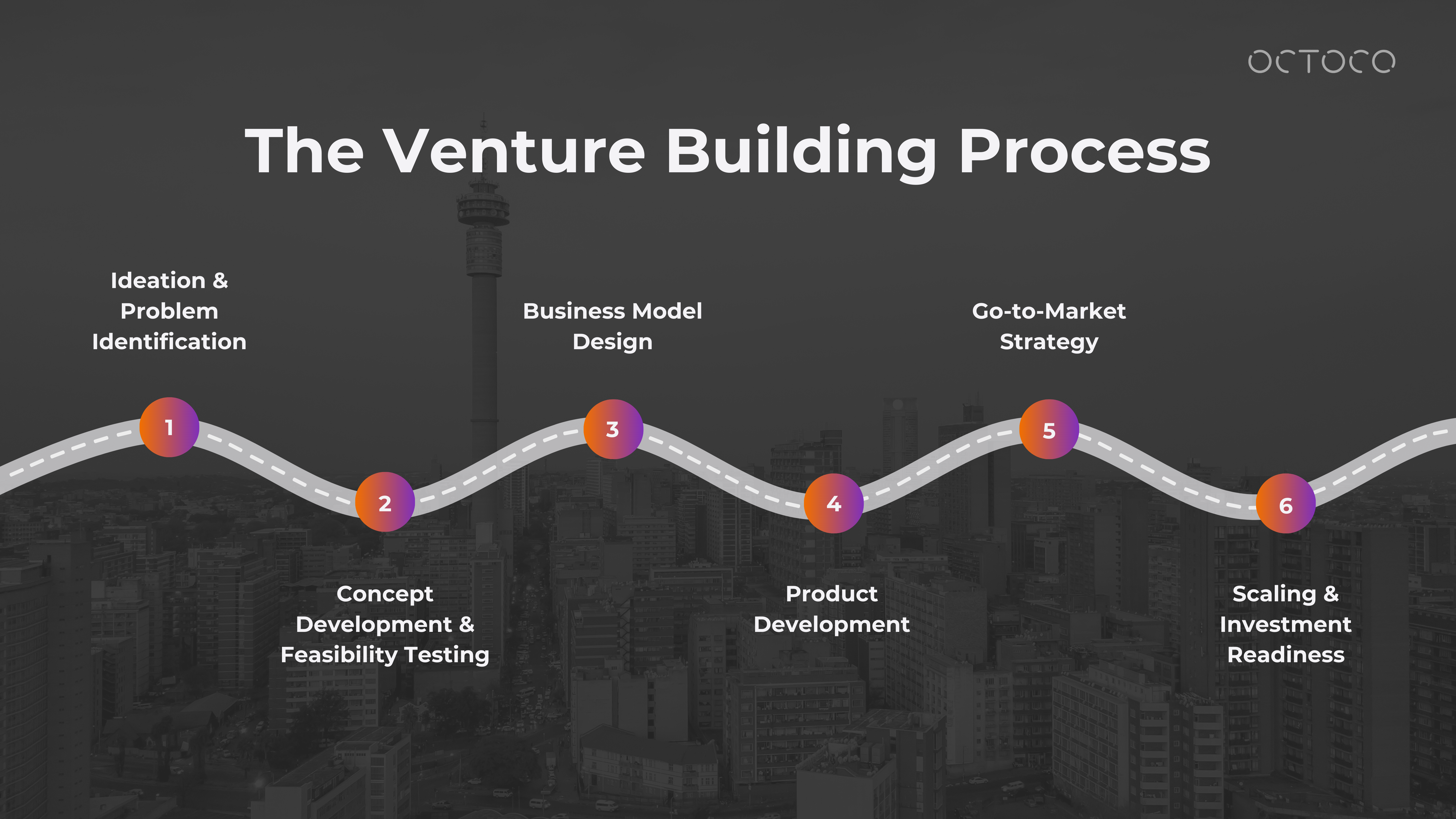

The Venture Building Process

1. Ideation & Problem Identification

Every venture begins with identifying real-world problems worth solving:

- Conduct market research to uncover gaps and emerging opportunities.

- Facilitate ideation workshops to generate viable business concepts.

- Prioritise ideas based on feasibility, strategic alignment, and market demand.

2. Concept Development & Feasibility Testing

Once an idea is selected, validate its potential through:

- Rapid prototyping: Develop early-stage product concepts (MVPs) for testing.

- Feasibility studies: Assess technical, operational, market and financial viability.

- Customer discovery: Interview target users to refine the value proposition.

3. Business Model Design

Turning a concept into a business requires a clear model for revenue generation and growth:

- Designing scalable and adaptable business models.

- Stress-testing financial projections and revenue streams.

- Mapping out customer acquisition and retention strategies.

4. Product Development

With a validated concept and business model in place, building the product starts:

- Hardware & software engineering: Develop robust MVPs tailored to client needs.

- Iterative development: Incorporate user feedback to refine features.

- Compliance & scalability: Ensure products meet regulatory standards and can scale efficiently.

5. Go-to-Market Strategy

Bringing the product to market involves careful planning and execution:

- Crafting comprehensive marketing and sales strategies.

- Leveraging corporate channels and partnerships for faster market entry.

- Monitoring early market response to optimise positioning.

6. Scaling & Investment Readiness

Once a venture gains traction, the focus shifts to growth and sustainability:

- Preparing ventures for internal funding or external investment.

- Scaling operations while maintaining product quality and customer satisfaction.

- Setting up long-term governance structures for sustained success.

Venture Building Pitfalls to Avoid

Many corporates may wonder, "Why can't our existing departments handle venture building?" After all, R&D teams innovate, marketing launches products, and operations scale businesses.

However, growing a new venture is fundamentally different from running an established business. Here are common pitfalls corporates face when trying to build ventures internally:

- Applying corporate processes to startups: Established companies thrive on efficiency and predictability, whereas new ventures require experimentation, agility, and rapid iteration. Traditional approval processes often slow down critical decision-making.

- Resource misalignment: While R&D or marketing departments focus on core business priorities, new ventures require dedicated, cross-functional teams with the freedom to pivot quickly without being pulled back into corporate responsibilities.

- Cultural clash: Corporate environments prioritise risk mitigation, while venture building thrives on calculated risk-taking and embracing failure as part of the learning process.

- Underestimating market dynamics: Ventures targeting new markets or technologies face unknowns that corporate teams may not be equipped to navigate. External venture builders bring fresh perspectives and specialised experience in uncharted territories.

- Insufficient customer focus: Internal teams may focus too much on internal metrics and existing customer bases, while new ventures need to prioritize discovering and addressing entirely different customer needs.

The best ways to avoid these? You need experienced venture builders. So that means one of two options:

- Either you have a previous successful venture builder (founder) to head up your venture

- Or you contract specialists who do it for a living.

Specialist Alternative: Venture Building Consulting

For corporates seeking a more advisory-led approach, Octoco offers venture-building consulting services. This includes strategic guidance, technical audits, and support in developing internal venture-building capabilities without full-scale operational involvement.

We’ve built, helped scale, invested and accelerated countless South African ventures – both startup and corporate ventures. See some of our past South African venture projects here.

Ready to future-proof and grow with venture building?